"Our integration with the Google Nest smart thermostats through Aidoo Pro represents an unprecedented leap forward for our industry."

- Antonio Mediato, founder and CEO of Airzone.

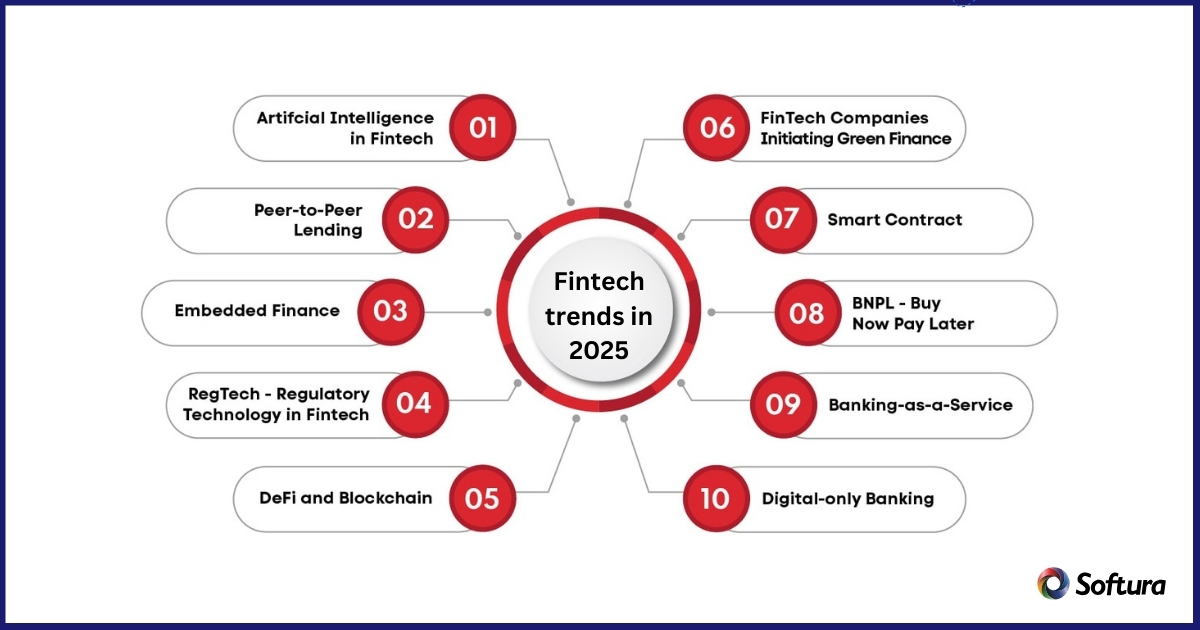

Fintech Trends is changing finance fast. It's happening now, and it's a big deal. As we come close to 2025, it's easy to see that things are shifting in a huge way. These changes will change how we use money. Fintech Trends right now are not just trends, they are what will make finance simpler, better, more for everyone.

What follows is not just a list. It's the future, things that will shape how you do your banking, your payments. Like putting finance in places, you wouldn't expect, or systems that do not need middlemen, these ideas will touch everybody, from big businesses to small consumers. Read on to stay focused and see what's next.

Embedded finance is a big thing for 2025. Its when you put finance stuff into things that aren't finance. Like, putting payments inside a shopping mobile app development, or letting people borrow money right where they shop.

This makes using money easier. People don’t need to leave an app or go somewhere else; they get what they need right there. Companies doing this make it simpler for customers, which makes people stick around longer. It also creates fresh opportunities for generating revenue in innovative ways.

"Our integration with the Google Nest smart thermostats through Aidoo Pro represents an unprecedented leap forward for our industry."

- Antonio Mediato, founder and CEO of Airzone.

Decentralized finance, called DeFi, is making financial stuff possible without banks. No middlemen. DeFi uses blockchain. By 2025, DeFi will have more products. Lending, saving, investing, it will all be possible, and for people who never had these options.

Blockchain tech like Ethereum makes this possible. It means safer, more open finance. And DeFi will be bigger in places where there aren’t many banks.

"By analyzing the data from our connected lights, devices and systems, our goal is to create additional value for our customers through data-enabled services that unlock new capabilities and experiences."

- Harsh Chitale, leader of Philips Lighting’s Professional Business.

Digital banks, sometimes called neobanks, are growing. They do not have branches, but they give you all the banking services on your phone. By 2025, these banks will be the most popular for younger people.

They make things easy. You can open an account fast, get insights on spending, and have a good experience, all without stepping into a branch. Traditional banks are slower to change, and digital-only banks are taking over fast.

"By analyzing the data from our connected lights, devices and systems, our goal is to create additional value for our customers through data-enabled services that unlock new capabilities and experiences."

- Harsh Chitale, leader of Philips Lighting’s Professional Business.

AI and data analytics are changing finance. By 2025, AI will make finance super personal. You will get advice for your investments, savings, or loans created just for you.

AI uses data to learn what customers do and what they need. That makes the services more personal. Machine learning means offers that match what you need, when you need them.

Want to create a digital-first banking solution?

Softura helps companies make fintech solutions that keep customers coming back.

"By analyzing the data from our connected lights, devices and systems, our goal is to create additional value for our customers through data-enabled services that unlock new capabilities and experiences."

- Harsh Chitale, leader of Philips Lighting’s Professional Business.

BNPL is not going anywhere soon. Into 2025, it will keep growing. People love it because its easy. You buy something, pay later, no regular loan hassles.

For companies, BNPL gives flexibility, and customers love it. With fintech getting better, BNPL is becoming safer and easier for people to use.

More people care about sustainability. Green fintech is growing. By 2025, companies will be offering climate friendly services. It might be an app that tracks your carbon footprint, or an investment that supports clean energy.

People want to know their money does good. Green fintech enables people to make financial decisions that match their personal values, focusing on both sustainable spending and investing. Fintech companies that focus on the planet will have the edge.

Security is a huge deal for fintech. By 2025, biometric security will be a normal part of fintech. Fingerprints, voice, even face, these will be used to prove who you are.

Digital transactions are going up, and security is more important than ever. Biometrics keep people safer and make things easier. Less passwords, more safety.

Fintech is changing fast. By 2025, things like embedded finance, AI, DeFi, digital-only banks, and green fintech trends will change how everyone uses money. Whether it’s making things easier or helping people invest with purpose, these Fintech trends will define the future of finance.

At Softura, we are here to help you stay ahead. We know where fintech is going, and we help companies make the most of these new opportunities. Ready to make a change in your financial services? Reach out today!

Let Softura help you build the future of finance.

Are you ready for your next project?

Unlock your company's full potential with our comprehensive Software development services. Contact our experts today to discuss how we can drive your success together.